The Question: Today I got this question via email from a reader.

Hi Kirk,

...... Appreciate your input on this. You probably have a good idea when Bob Brinker became a fan of index funds.....

Is Bob Brinker's recollection correct on this? I have serious doubts about it.

On last Sunday's Moneytalk, Bob Brinker took a call from Rich in Novato, CA, at the 20 minute mark of the first hour.

Rich read to Brinker what the Wall Street Journal reported about Warren Buffett recommending a portfolio of 90% S&P 500 Index Fund and 10% short term government bonds.

At the very end of the conversation with Rich, Bob Brinker said something that I have serious doubts about

“Going all the way back to the beginning of the Moneytalk broadcast series going all the way back to 1986, I have continuously stated that if I had to choose one fund for stock market investing it would be a low cost total stock market index fund, and low cost funds are available at places like Vanguard and Fidelity that are total stock market index funds with very very low expenses, and I’ve been consistent on that for 29 years”In the early to mid-1990's and perhaps even much later, Brinker had no index funds in Marketimer.

He was not emphasizing low cost mutual funds, and I specifically remember he once had the PBHG Growth fund in Model Portfolio I, and I believe it had a 2.0% expense ratio (which I think was his limit for an expense ratio).

I distinctly recall a Moneytalk caller asking him about investing in stock index funds, as the caller was interested in investing that way.

Brinker told him "It's not the way I prefer to do it, but if you are going to do it, at least diversify internationally"

During this time frame, I had the distinct impression that Brinker did not like index investing one bit. He focused a tremendous amount of energy and attention trying to pick actively managed stock funds that would beat the market.

I felt that he joined the index investing crowd only when the evidence became overwhelming that actively managed funds as a rule have a very difficult time beating the index funds.

Now he says that since 1986 he's been saying xyz about index funds.

Maybe I'm wrong, and there are many long-term listeners and subscribers out there who can set the record straight.

Would some of the long time listeners and subscribers please chime in and let me know what Bob Brinker's position on index funds was? I don't think he came onboard the index fund bandwagon until very late in the game.

My Answer (In Progress):

I think his reply is "partially true" at best.

For starters, Vanguard and Fidelity didn't start their total market index funds until the 1990s. Vanguard was the first and Fidelity came a few years later.

|

| How do you recommend something in 1986 that didn't exist until 1992? |

Also, Brinker's newsletter didn't have them as recommended or model portfolio funds in the 1993 Marketimer newsletter.

Thus, taken literally, Brinker was not being truthful when he said....

“Going all the way back to the beginning of the Moneytalk broadcast series going all the way back to 1986, I have continuously stated that if I had to choose one fund for stock market investing it would be a low cost total stock market index fund, and low cost funds are available at places like Vanguard and Fidelity that are total stock market index funds with very very low expenses, and I’ve been consistent on that for 29 yearsBrinker did list the S&P500 and Extended Market index funds from Vanguard in his 1993 recommended fund list so you could construct the total stock market yourself with these funds (as I do in my newsletter core portfolios) if you had guidance on how to allocate your dollars between the two.

Before you take any of his advice, you must be aware that Brinker is one of the best self promoters ever to grace the radio waves. I've followed him for over 20 years and his advice and newsletter seems to me (my opinion) to be designed more to use as sample issues than good investment advice.

In his Marketimer newsletter, Bob Brinker has:

- Recommended Model Portfolios

- Recommended Mutual Funds

- Recommended Individual Issues

- Recently added "Active Passive Portfolio."

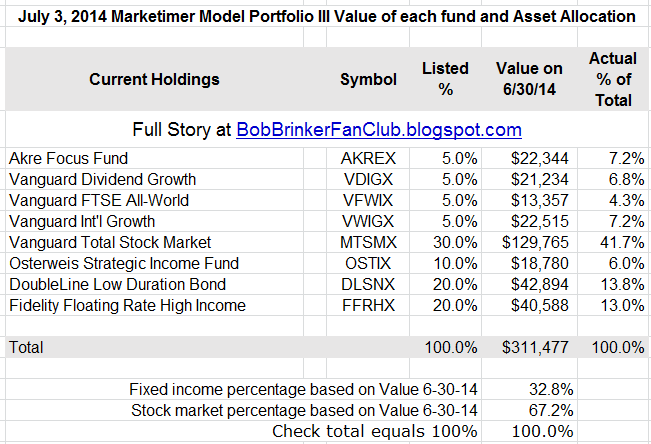

- For more, read Bob Brinker's Model Portfolio III

This is excerpts from the November 1993 Marketimer. Note:

- Portfolio 3 is not balanced

- He does not compare the performance to index funds or any other benchmarks.

- The beta is wrong since it applies to the total value in the portfolios and he calculates it based on % listed.

- There are NO INDEX FUNDS in any model portfolio!

Also, if you have the time, calculate how "balanced" his model portfolio three was in December 1999 with roughly $39.7K in fixed income (first two funds) and $67.7K in equities while still advertising the fund as "balanced" allocated evenly between fixed income and equities!

Recommended Mutual Funds: Each issue of Marketimer also has "Bob Brinker's Recommended List of No-Load Funds." My copy of the November 5, 1993 Marketimer has on

- Pg. 4: 8 managed funds with expense ratios between 1.00% and 1.84%

- Pg. 5: 8 managed funds with expense ratios between 1.00% and 1.70%

- Pg. 6: 6 managed funds with expense ratios between 0.27% and 1.90%

and 2 Vanguard index funds with expense ratios of 0.20%

Recommended Individual Issues: These are individual stocks, ETFs, closed end funds, etc. that he recommends but seldom puts in his model portfolios. The most famous is the QQQ advice with the recent addition then removal of GLD discussed above.

"Active Passive Portfolio: Brinker didn't have this in 1993 Marketimer nor was it in the last issue of the 1990s, the December 1999 newsletter. Here is what he recommended in those issues for model portfolios.

Bottom Line: Total stock market index funds were not available for purchase in 1986 at either Vanguard or Fidelity.

Bob Brinker may have had index funds on his list of recommended funds, but index funds were not in his model portfolios or list of individual issues (Not sure ETFs existed back in 1993.)

Brinker can say he's "recommended index funds in his newsletter" since at least 1993 which is as far back as I have issues. When he sends you a recent sample issue you will see the recently added "Active Passive Portfolio" which you might assume he recommended portfolios with index funds all along which would be a false assumption but one easy to make given what he said on the radio.

If anyone remembers when Brinker first added the active-passive portfolio to Marketimer, please post this in the comments or send me an email.

Check back as I'll probably update this again.