Email Alerts for New Articles: Click "Follow" on the right hand side of this blog and it (Google Blogger) should send you a FREE alert via email when I publish a new article here. I am pretty sure it does not send email alerts when I make updates to the articles so I will try to write "check back" if I plan to add to the article.

Market Update: The four major US stock indexes I track are all in the green year-to-date (YTD) with the Nasdaq up 7.6% and the Dow only up 0.7%.

This year the market as measured by the S&P 500 had its fourth largest correction of 12% since the secular bull market began in March of 2009. It would be very bullish if the S&P 500 corrects down to the falling upper dashed green support line then quickly reverses.

Likewise, it would be very bearish for it to drop below the lower dashed green support line where filling the gap at 20% off the record high would be highly probable.

Bob Brinker remains firmly in the Bull Camp:

- Bob Brinker did not issue a "Special Bulletin" to take profits before that correction nor did he issue a bulletin to buy when the market was down 12%.

- Since March 2003, Bob Brinker has had his portfolios one and two 100% in equity mutual funds. See Bob Brinker's Asset Allocation History.

- Brinker continues to favor dollar cost averaging new money into the market "especially during periods of weakness" which he has not defined.

- Brinker says if a "Marketimer buy signal develops" between his monthly newsletters, then he will "post a Special Subscriber Message for access" at his website. How old fashioned is that? I send email alerts the same day, usually within hours when I buy or sell something in my portfolio. Below my newsletter ad is an example.

- Reading between the lines, the fact Brinker only talks about a special message for a "Buy Signal" between monthly newsletters is a clear indication he's firmly in the Bull camp.

Many of my online friends who follow the markets and especially Brinker lost faith in how he handled this miss. That is he didn't discuss why he was wrong or what he learned.

My guess is the markets look similar today... they've have a huge run up but are not over valued like they were in 2000 but they are highly valued on a PE ratio basis as you can see in my table in my Brinker article "Bob Brinker Stock Market Targets."

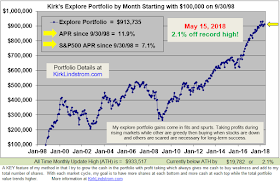

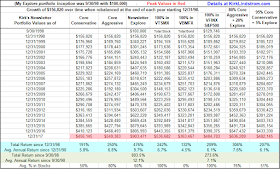

Kirk Lindstrom's Investment Letter

Subscribe NOW and get the May 2018 Issue for FREE!!!

SPECIAL BENEFIT: All questions about what I write answered by Email.

If what I write is not clear to you, just ask!

If what I write is not clear to you, just ask!

(Your 1 year, 12 issue subscription with SPECIAL ALERT emails will start with November issue.

Get email alerts when I buy or sell securities for my explore portfolio

"Auto Buy" and "Auto Sell" levels set ahead of time for target buy and sell levels for my securities. This allows you to place "limit orders" with your broker in advance so you can go about your business.

More articles:- Bob Brinker Stock Market Targets

- Beware of Annuities

- Winning the Zigs, losing on the Zags - Why small investors usually do poorly

- Make Money In A Flat Market With Asset Allocation & Market Volatility