These are painful, but if you raised cash following my newsletter, then you have plenty of cash to go shopping during the Holiday Sales!

|

| An example of some of my sell alerts |

The infamous FAANG stocks (table below) remind me of the "Nifty Fifty" in many ways.

On a closing basis, you could stretch the truth and say we haven't hit an "official bear market" yet since the S&P 500 is "only down 19.8%. But if you round to zero decimal places then the S&P 500 is down 20%.

Bob Brinker has taught for decades, what really matters is the Total Stock Market index (VTSMX) and that as well into a bear market due to the small cap stocks getting hit harder than the large cap stocks.

Discuss this article on my "Investing for the Long Term" Facebook Group here.

Subscribe NOW and get

the December 2018 Issue for FREE!!!

the December 2018 Issue for FREE!!!

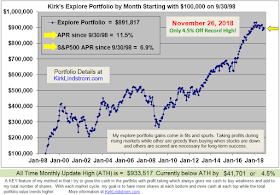

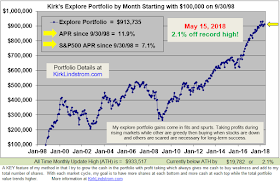

New Article 12/26/18: Market Down 20%, Fear is Everywhere & President Trump Says a Great Opportunity to Buy