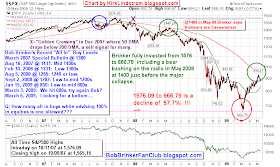

Bob Brinker is bullish, is 100% invested in equities and recommends using "periods of weakness" to get to 100% equities. Robert Prechter, who unlike Brinker correctly called the 1987 bear market, continues to recommend US Treasuries and "cash like" securities because he thinks this is a bear market rally before the market rolls over to new lows, perhaps as low as 50% below the recent S&P500 low of 676!

Dow 8,284.41

Nasdaq 1,687.10

S&P500 884.89

Markets at a glance

- Kirk's Market Thoughts 3/28/08: ECRI Calls it "A Recession of Choice"

- Bob Brinker's 5/31/08: Cassandra Bashing

Last year, Bob Brinker advised using weakness below "mid 1400s" as a "gift horse buying opportunity" to get his subscribers 100% in equities if they were not already there per his newsletter advice.

Last weekend Bob Brinker made it very clear to his audience he recommends "buying on weakness" and he expects large gains for 2009. I hope this is not another sign of a top after the market touched its 200 day moving average like it did a year ago when he bashed us Cassandras.

Last weekend Bob Brinker made it very clear to his audience he recommends "buying on weakness" and he expects large gains for 2009. I hope this is not another sign of a top after the market touched its 200 day moving average like it did a year ago when he bashed us Cassandras.

Robert Prechter continued to warn that the stock market was headed lower.

It turns out Prechter was the profit last year while Brinker has egg on his face.

Unlike Bob Brinker and Prechter, I don't pretend to be able to time the market (for more than a few percent of my assets in my explore portfolio) so I took profits to get back to my target asset allocation of 70% equities after using market weakness to add to positions.

From "Robert Prechter Predicts Deflation, Depression and New Market Lows," Prechter said:

- "Our models are (showing) right now that it is a much bigger bear market than most people realize, something along the lines of 1929-1932"

- "I think the next leg down will be at least as severe if not more severe than what we just experienced. So you want to stay on the side of safety"

In his 2002 book "Conquer the Crash," Prechter warned of a debt bubble with deflationary depression while recommending US Treasuries. Today he still likes US Treasuries. (See US Treasury Rates at at Glance.)

Who is the Cassandra and who is a prophet this time?

Who is the Cassandra and who is a prophet this time?

- Post your answer in the comment section.

Doubled Money in a Down Market!

Since 12/31/98 "Kirk's Newsletter Explore Portfolio" is UP 104% (over a double!) vs. the S&P500 DOWN 16% vs. NASDAQ down 22% vs. Warren Buffett's Berkshire Hathaway (BRKA) up 33% (All through 4/30/09 )

As of April 30, 2009, "Kirk's Newsletter Explore Portfolio" is up 5.2% YTD vs. DJIA DOWN 6.9% vs. S&P500 DOWN 2.5%.

(More Info & FREE Sample Issue)

As of April 30, 2009, "Kirk's Newsletter Explore Portfolio" is up 5.2% YTD vs. DJIA DOWN 6.9% vs. S&P500 DOWN 2.5%.

(More Info & FREE Sample Issue)

Conquer the Crash: You Can Survive and Prosper in a Deflationary Depression

(Hardcover w/ Updates for 2009)

by Robert R. Prechter Jr (Author), Robert R Prechter Jr (Editor)

Price: $27.95 & this item ships for FREE with Super Saver Shipping

More Info:

- US Treasury Rates at a Glance

- May 14 Reuters interview

- ~1995 Barron's Interview

From: da_cheif™ 7/12/2005 9:04:36 PM

prechter was interviewed by barrons about 10 years ago...when the dow was at 3500.....he sed that if the dow ever went about 4000 it would prove he didnt know what he was talking about and that nobody should pay attention to him again......lolol.....thats why the recognition wave is still ahead.....it will make the 90s look like childs play....snort - LIBOR Rates at a Glance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.