What does Bob Brinker have in common with David Kostin, Barry Knapp, Dan Chung, Richard Bernstein, David Bianco, Abby Joseph Cohen, and Bob Doll?

The answer is they are all bullish as 2010 ends and we enter 2011 but Bob Brinker is the least bullish of these experts.

Honeybee reported on Sunday (Dec. 26, 2010) Bob Brinker's current market outlook:

Bob Brinker's latest stock market views:

- Brinker is bullish on the stock market, his portfolios are fully invested and his S&P 500 Index target range for 2011 is: Marketimer, December 3, 2010, Bob Brinker said: "....we project a target range in the low-to-mid 1300's for the S&P 500 Index as we move forward in 2011."

With the S&P500 currently at 1,258.51 (Quote and chart), low 1300s is not much of a reach. Others are going more out on a limb with predictions of mid 1400s to 1500!

In the comments section of the same article, sivbum summarized the targets for other gurus:

- Besides BB's bullish call, there are a bunch more:

- David Kostin, Goldman Sachs, target is 1450.

- Barry Knapp, Barclay’s (BCS) has a 1420 year end target.

- Dan Chung, Alger Funds, hit 1500-plus at some point in the S&P 500 next year.

- Richard Bernstein expects about a 15% rise on the S&P 500 in the next 12 months.

- David Bianco, Bank of America Merrill Lynch, has about 15% in total returns.

- Abby Joseph Cohen, Goldman Sachs,12-month market forecast for the S&P is 1450.

- Bob Doll, Black Rock, double digit returns, including dividends.

You have to take what they say with a grain of salt, Honeybee also reported:

Interesting to compare what Brinker was saying three years ago before the market dropped over 57%:

- January 4, 2008 Marketimer, Page 3; Paragraph 1; (S&P 1468.36), Bob Brinker said: "In summary....conditions are favorable for the market as we enter 2008. We expect the S&P 500 Index to achieve new record highs this year and to reach the 1600's range in the process. We continue to rate the market attractive for purchase on any weakness into the S&P 500 index mid-1400's range. Above that range we prefer a dollar-cost- average approach for new purchases. All Marketimer Model Portfolios remain fully invested as we enter 2008......And I believe those new all-time-historic-record highs will develop as we move into 2009."

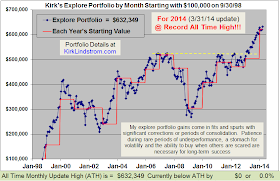

Since 12/31/98 "Kirk's Newsletter Explore Portfolio" is UP 213% vs. the S&P500 UP only 25% vs. NASDAQ UP a only 22% (All through 12/27/10)

In 2009, "Kirk's Newsletter Explore Portfolio" gained 33.5% vs. the DJIA up 18.8%

2010 YTD my "Explore Portfolio" is up 20.7% YTD

(the explore portfolio has 70% in equities and 30% in fixed income so the stocks are doing very, very well)

In 2009, "Kirk's Newsletter Explore Portfolio" gained 33.5% vs. the DJIA up 18.8%

2010 YTD my "Explore Portfolio" is up 20.7% YTD

(the explore portfolio has 70% in equities and 30% in fixed income so the stocks are doing very, very well)

Today's market closing numbers:

| Dow | 11,575.54 | +20.51 | +0.18% |

| Nasdaq | 2,662.88 | -4.39 | -0.16% |

| S&P 500 | 1,258.51 | +0.97 | +0.08% |

| 10 Yr Bond(%) | 3.4810% | +0.1300 | |

| Oil | 91.25 | +0.25 | +0.27% |

| Gold | 1,405.90 | +23.50 | +1.70% |

Returns for last 12 years: 2010 YTD through 12/15/10

: : |

| Click for Full Size Table Subscribe Now |