The following commentary is from my "Retirement Advisor" writing partner, David Korn.

Brinker Comment: A December 13th deadline has been established for the House Senate Committee to come together for a new budget agreement. This is what we wound up with after the government shut down was completed in October. The word we are getting is that all they are trying to do is to curb the sequester cuts that are mandated from the last time they failed to reach an agreement. This includes $19 billion that will hit pentagon budgets in January. The lack of leadership in Washington D.C. That seems capable of leading on fiscal issues. What happens if an agreement isn’t reached on December 13th? Nothing really. There is no immediate consequence. There was a budget resolution back in 2009 that sets the spending parameters for the federal government but haven’t had once since that time. What we have had is a lot of partisan fighting. The disagreements we have now are the same as always; some want entitlements cut, others want additional tax revenues.

Can our current situation go on forever? No. We need reform to entitlement spending including Medicare, Medicaid and Social Security because that accounts for almost 50% of our federal government spending. But to do that you have to get past the lobbyists that swarm capital hill and the special interest groups, like the AARP that have 37 million members who don’t want to see changes that would result in any diminution of benefits. That is just one example of a powerful lobbying group and this is one reason you don’t reform.

EC(David Korn): The real important deadline is January 15 when the government funding again expires. Read the article, “Do-Nothing Congress Dithers on Budget as Deadline Nears” at this url: http://tinyurl.com/qhd9p3n

Brinker Comment: Did Bowles-Simpson come up with some good ideas for reform? Yes, but they have basically been ignored. Even Simpson and Bowles failed to address the black hole called Medicare which is unsustainable. The average couple pays in about $130,000 into Medicare while they get back about $350,000 in lifetime benefits. And Social Security as it is constituted is going nowhere as the current workforce pays in a smaller amount to a growing number of beneficiaries. Our country is fooling itself by thinking that the low interest rate environment we are currently in will allow us to continue to borrow at the same pace. Our leaders fail to recall that the average interest rate we have had to pay on our national debt is 5.8%. Even though it is at 2% right now that won’t last forever. A 4% increase in interest rate would cost us $600 billion in interest per year — or $6 trillion over 10 years in interest expense.

Caller: Shouldn't the government consider indexing benefits to social security to inflation? Bob said the schedule of payouts to social security has an inflation component in it. The rate of return earned by social security has always been pegged to the rate of return on the Treasuries as mandated by law. They don’t have any choice. There was an effort by George W. Bush to put a portion of the social security money into the stock market but that effort was shot down in a big way.

Kirk's Comment: See Social Security COLA for 2014

- Notice that the cap on the upper rate is going up far faster than inflation which is a tax increase on those making more than the cap.

- "For those of us still working, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase 2.9% to $117,000 from $113,700."

- Kirk Lindstrom's Investment LetterDon't Miss Out!Subscribe Now

Get December Issue for Free!

EC: The 29-member bipartisan panel faces a December 13th deadline but as Bob noted these panels don’t seem to have much success. There have been over a dozen panels convened since the end of WWII but their recommendations have rarely spurred congressional action.

Caller: What kind of carnage can we expect and when can we expect to see it if our government continues down its present fiscal spending path? Bob said the timeline is difficult to predict, but certainly we are headed to oblivion if we don’t make cuts in Medicare, Medicaid and Social Security in that order of priority. What is the worse kind of outcome? That would be if our national debt continued to explode against a backdrop of higher interest rates which made the interest carrying costs unsustainable. Suppose you had the government bonds downgraded beyond investment grade level, you would have a hard time finding ways to borrow the money without paying an exorbitant interest rates. That would be the worst case of scenario.

Caller: What have you heard about reform in social security, such as a cut-off point in income for social security of they go with means testing? Bob said the discussions haven’t got that far at all. Ironically, social security is the easiest of all the entitlements to fix. The age expectancy has gone way up since the social security program was developed. They could simply extend the age by a month or two down the road when you are able to take benefits. This could be done over a period of many years and it would enable them to greatly expand the viability of the program. This is an easy solution that our government can’t even tackle.

Caller: This caller noted that the US Government has tons of property across the United States. Why not sell some of those assets or lease them out and put the money in a sovereign nation fund and use some of that money to pay off social security. Bob said the votes are not there for that. Not even close to enough votes for that kind of proposal.

Brinker Comment: Bob said the Medicare program is where the money is and that program has the potential to really bankrupt the economy. But we have known it needs to be fixed for years and they haven’t done it. The closest thing we got was Simpson Bowles but even they couldn’t get it done. There is so many powerful forces lobbying against the reform of this it will take real leadership of our government officials to get it done.

Caller: This caller asked Bob why he doesn’t comment on cutting spending in the other half of the budget where, for example, there is extreme wasteful defense spending going on. Bob got a little “defensive” so to speak, and told the caller he must not listen to Moneytalk because Bob has cited with approval the views of Senator Coburn who has said there is 5-10% fat in the defense budget and for that reason, Bob said the sequestration’s cuts in defense spending hasn’t bothered him all that much.

EC: Senator Tom Coburn (R-OK) released an oversight report entitled, “Department of Everything” which outlines how the Department of Defense could save $67.9 billion over ten years by making specific cuts to “non-defense” defense spending — spending that DOD can cut without cutting vital defense priorities. You can read the report at this url: http://tinyurl.com/cavewxa

Best Retirement Newsletter

Read "Kirk's Two Investment Letters - Best Retirement Portfolio For You" to decide which newsletter I offer is best for you.

Commentary is courtesy of my writing partner, David Korn:

David Korn's Stock Market Commentary, Interpretation of Moneytalk (Bob Brinker Host), Financial Education, Helpful Links, Guest Editorials, and Special Alert E-Mail Service. Copyright David Korn, L.L.C. 2013

If you would like a free sample of David's complete "Brinker related newsletter" and his "Retirement Advisor" newsletter, then click this link to send an email request and please tell us a bit about yourself too.

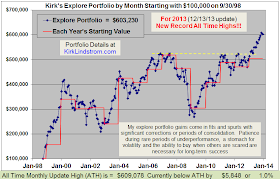

This table shows my newsletter "Core and Explore Portfolios" from 1998 through the end of Q3

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.