WARNING! Bob Brinker's "Balanced" Model Portfolio Three is NOT balanced!

- A balanced portfolio has half in stocks and half in fixed income that typically goes up when stocks go down

- Brinker's Model Portfolio 3 is over 2/3rds in stocks!

- Brinker's Model Portfolio 3 contains "risky" fixed income funds that have a positive correlation to the stock market. That is the "junk bonds" will typically lose value during a recession when stock prices also fall.

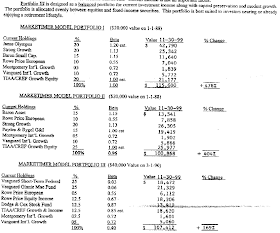

Brinker may show percentages that are 50% in equities and 50% in fixed income and often speaks of how this is to reduce risk during bear markets. I caution readers that the percentages Brinker recommends are not what he has in these portfolios. For example, this (repeated below) would lead you to think his "balanced" Model Portfolio III is half in stocks and half in fixed income, but if you look at the dollars he lists each month, he has the portfolio over two thirds in equities, not half!

Here is Bob Brinker's Model Portfolio III, which is a 50% equities/50% fixed income portfolio, "best suited to investors nearing or already enjoying a retirement lifestyle". As of March 4, 2014 Marketimer newsletter:

Akre Focus Fund (AKREX): 5%

Vanguard Dividend Growth (VDIGX): 5%

Vanguard FTSE All-World ex US Index (VFWIX): 5%

Vanguard International Growth (VWIGX): 5%

Vanguard Total Stock Market (VTSMX): 30%

Osterweis Strategic Income Fund (OSTIX): 10%

DoubleLine Low Duration Bond (DLSNX): 20%

Fidelity Floating Rate High Income (FFRHX): 20%

Stock fund vs Bond Funds

Brinker doesn't rebalance his portfolios to 50% stocks. As a result, when the markets are going up, he can report higher returns than competitors who rebalance.

Here is the composition of Model Portfolio 3 just before the biggest bear market since the great depression:

|

| click images to see full size |

Another result that he doesn't talk about is these portfolios give up far more to the downside from their peaks during bear markets.

One of my readers sent me this a few days ago showing the totals for the portfolios and the percentages Brinker shows. I added a column at the right that calculates the ACTUAL portfolio allocation to each fund.

That is the portfolios with two thirds in stocks have far more risk than "typical" balanced portfolios like the ones I recommend in my newsletters. See

- "Kirk's Two Investment Letters - Which is Best for You?"

ALL the funds in my core portfolios are at Vanguard but I give ETF substitutions for those who want to use Fidelity, Schwab, etc.... I rebalance about once a year so the costs are tiny and you can avoid those by using the free to trade funds at those fund families, also listed in the newsletter as alternatives.

Another factor is taxes from switching funds, which Brinker does often and I almost never do except for eliminating total bond fund until rates normalize to reduce risk.