Kirk's Stock Market & Sentiment Charts for Feb. 9, 2018

Email Alerts for New Articles: Click "Follow" on the right hand side of this blog and it (Google Blogger) should send you a FREE alert via email when I publish a new article here. I am pretty sure it does not send email alerts when I make updates to the articles so I will try to write "check back" if I plan to add to the article.

Bob Brinker, in his February 2018 "Marketimer" newsletter, remains fully invested with his model portfolios one and two 100% in stocks. He has not taken any profits or raised any cash in his Model Portfolio One or Two, that are 100% in stocks, for any potential corrections or bear markets. Due to rising interest rates, in his Model Portfolio Three and "Income Portfolio," Bob said he will sell one of the three bond funds on Feb. 12 and put the funds in a money market fund. Interest rates are already up significantly this year so that fund will probably show a loss for the year.

Bob believes any declines will be contained by either a "minor correction category of 5% to 10%, or the major correction category of 10% to 20%."

Special update for 2/8/18: We are there now!

Bob's Advice for New Money: Bob continues to say "we recommend a dollar-cost-average approach for new money, especially during periods of market weakness."

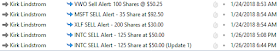

Kirk Lindstrom's Investment Letter

Subscribe NOW and get the January 2018 Issue for FREE!!!

(Your 1 year, 12 issue subscription with SPECIAL ALERT emails will start with November issue.

Recently a reader send me this question about investing a "large sum of money."

I’m listening to Brinker right now. He just had a woman call in telling him she had a large sum of money and gave Bob a variety of ways to invest it in the market asked Bob which was the best way to go. Bob segwayed into asset allocation....and never did say which was the best way to invest a large sum of money in the market.

Do you have a recommendation on the best way to invest a large sum of money in the market?

Here is my reply

If you don't mind, I'll use your EXCELLENT question for a short blog post and share my reply.

Statistics show lump sum is best as many (perhaps thousands) listen to Brinker and think they should DCA on "weakness" which he usually doesn't define. Many may never get in until a market top just as they give up waiting for weakness in what is called "FOMO" or Fear Of Missing Out.

IF you have the discipline to do monthly DCA into the funds I recommend in my newsletter, you can have Vanguard set it up for you automatically since all my funds are at Vanguard with ETF equivalents you can buy anywhere, then do the DCA following the plan listed on pg 35 or my January 2018 newsletter near the bottom.

As for asset allocation, I like being aggressive with money I made and saved while working but for inherited money, I like to keep the memory of who gave it to you alive so I recommend that go into my "Core Conservative" portfolio.

Brinker is far too careful to make sure he doesn't give any advice that someone can say was "wrong" with market timing and cares less about helping people. Think of all the years he's said to " DCA on "weakness" and the market pretty much went straight up! You can see from my advice on pg 34 of my newsletter that I have a SIMPLE PLAN to accelerate DCA payments if the market corrects.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.