Email Alerts for New Articles: Click "Follow" on the right hand side of this blog and it (Google Blogger) should send you a FREE alert via email when I publish a new article here. I am pretty sure it does not send email alerts when I make updates to the articles so I will try to write "check back" if I plan to add to the article.

Market Update:

- The four major US stock market indexes have been down over 10% from their peaks twice this year.

- Currently the Dow, S&P 500 and Russell 2000 indexes are down for the year while the Nasdaq is up a fraction.

- Currently only the Dow remains in the "10% or more" correction zone.

- Many of my "indicators" have shown this decline is another great time to put profits taken just a month ago back into the market so I have done so. Here are a few of my graphs showing why.

-

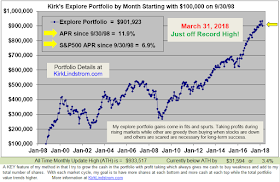

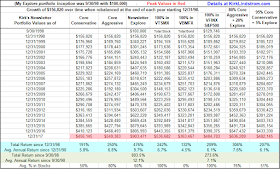

- This "volatile period" has been great! It has provided us (subscribers to Kirk Lindstrom's Investment Letter Service) excellent opportunities to take many profits near the top and then buy back some on the two declines for my Explore Portfolio.

Note, if this much excitement is too much for you, I recommend ignoring the Explore Portfolio and just follow one of my "Core Portfolios" where I seldom make changes (usually once a year at a minimum.)

Bob Brinker Investment Advice: In his April 2018 "Marketimer" newsletter, remains fully invested with his model portfolios one and two 100% in stocks. He has not taken any profits or raised any cash in his Model Portfolio One or Two, that are 100% in stocks, for any potential corrections or bear markets.

Brinker discusses some past buy signals, but still has not issued a new one for this latest correction that has again exceeded double digits for the major averages.

Brinker discussed his five root causes of a bear market but never got around to saying if one was on the horizon other than say:

"We expect the recent increase in stock market volatility to continue in 2018 as such market activity is typical in the latter stages of an economic cycle."So, Brinker has his "assets" covered should we fall into a bear market and/or a recession without having said explicitly if he sees either on the horizon as he has done in past newsletters.

Brinker also has his "assets covered" if the market resumes its bull run as his model portfolios are "fully invested" and his advice is:

"For now, we continue to recommend a dollar-cost-average approach for new stock market investing, especially during periods of market weakness in this highly volatile environment. All Marketimer equity allocations in our model portfolios remain fully invested. In our view, the primary market uptrend remains intact."

Remember, Brinker has had "All Marketimer equity allocations" in their model portfolios "fully invested" since March 2003, over 15 years! [See Bob Brinker's Asset Allocation History for details.] Brinker missed the biggest bear market and recession since the Great Depression so take it all with a grain of salt if you believe he can get out near the top for a smaller decline then get back into the market at level low enough to make it worth losing to taxes and fees..

Kirk Lindstrom's Investment Letter

Subscribe NOW and get the April 2018 Issue for FREE!!!

(Your 1 year, 12 issue subscription with SPECIAL ALERT emails will start with November issue.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.