October 1st, 1941 - August 18th, 2024

Search Bob Brinker Fan Club Blogs

Tuesday, August 20, 2024

RIP Bob Brinker - October 1st, 1941 - August 18th, 2024

RIP Bob Brinker

Robert John Brinker

Robert J. Brinker passed away peacefully at the age of 82 in Santa Fe, New Mexico. Born and raised in Philadelphia, Pennsylvania, Bob lived a life filled with love, dedication, and remarkable achievements.

Bob attended La Salle College High School and continued his education at La Salle University and Temple University, where he developed a passion for both radio broadcasting and finance. His career in these fields was marked by professionalism and a commitment to excellence.

Bob is survived by his wife Hilary, with whom he shared his life for more than 60 years. Together, they built a family rooted in unconditional love and support. He will be remembered by his daughter Denise, his son Robert, his daughter-in-law Lisa, and his son-in-law Peter, as well as his five grandchildren Ashley, Zachary, Lily, Viola, and Conrad. His memory will also be cherished by his brother Ken and sister Diane. Bob was preceded in death by his daughter Caroline, his brother Johnny, his sister Edna, his mother Edna, and his father Robert.

Bob will be missed by those who tuned in on weekends to hear his voice on their radio. For more than 30 years Bob hosted the nationally syndicated ABC radio program Moneytalk. The starship Moneytalk entertained and educated listeners on all topics relating to personal finance, helping guide listeners on their journey to the land of critical mass.

The family kindly requests that donations be made to UNICEF [ https://unicef.org/ ], a cause close to Bob’s heart. Your contribution will help continue the work he cared so deeply about.

From Robert Brinker Obituary | Rivera Family Funeral Home-Santa Fe Funeral at https://rivera.mykeeper.com/RobertBrinker

Thursday, November 02, 2023

AAII and II Sentiment Update

🐂📈Kirk Lindstrom's Investor Bull/Bear Sentiment Charts for 11/2/23 📉🐻

Bob Brinker was the first radio host I knew who spoke of applying contrarian theory to investor sentiment. There is an old Wall Street adage, "Buy when there is blood in the streets" but Brinker gets kudos for bringing this theory to the small, individual investor.

Reminder, you can follow this feed (subscribe for free) and get sent emails by Google when I post new charts and articles here. Just click "Follow" below.

11/2/23 Notes:

- There is a large divergence between professional newsletter writers (II) and individual investors (AAII) sentiment.

- II is "neutral" but its decline is large enough to support another rally.

- AAII below negative 20% is bullish for contrarians

Graphs below best viewed in full screen mode.

II Bulls and Bears Sentiment Graphs

AAII Bulls and Bears Sentiment Graphs: The AAII Investor Sentiment Survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months.

These charts are covered on page 6 of my newsletter with updates during the year for what the different types of sentiment charts mean to me. This is an easy place to give my subscribers updates of charts too numerous to add each month I cover.

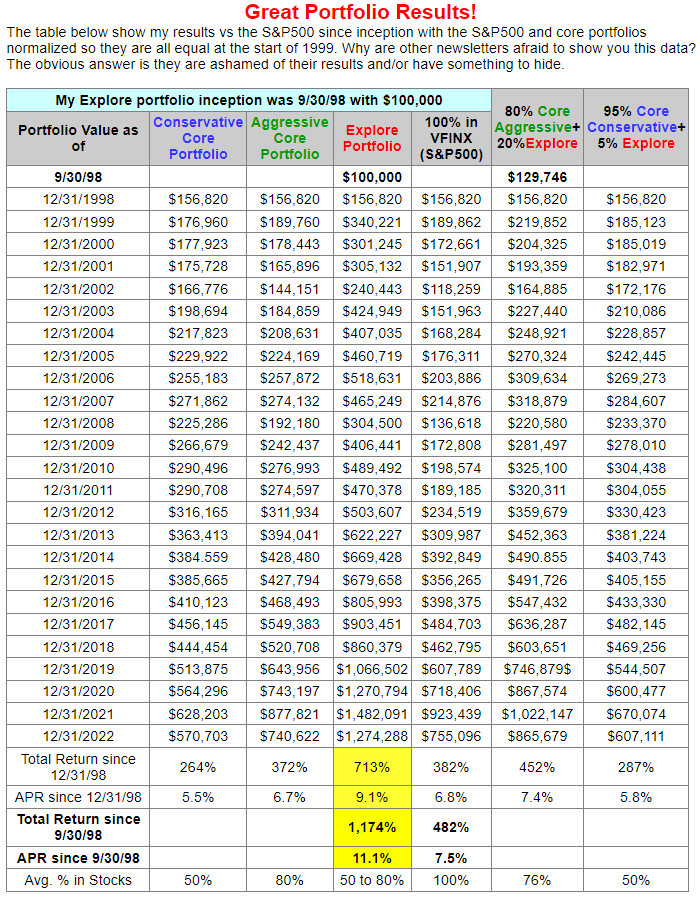

To see what stocks and ETFs are in my "Explore Portfolio" and get a full list of on my price targets to both take profits or buy more:

Subscribe NOW and get

the November 2023 Issue for FREE!!!

(If you mention this ad)

the November 2023 Issue for FREE!!!

(If you mention this ad)

Subscribe to:

Posts (Atom)

FREE Updates Mailing List

We email regular "FREE Bob Brinker Fan Club Updates" to everyone on our "Bob Brinker Fan Club" distribution list. If you would like to get on this list, then click this link.

Top Rated Newsletter

Timer Digest Features

Kirk Lindstrom's Investment Letter

on its Cover

Cick to read the full page article!

US Treasury Rates at a Glance - iBond Rates - LIBOR Rates

Must Read: Beware of Annuities - Payday Loans Warning