It is great to have happy newsletter subscribers recommend me to their friends!

Post by Chris Ellsworth.

This table shows my newsletter "Core and Explore Portfolios" from 1998 through the end of Q3

On today's Moneytalk Program in the 2nd hour, Brinker discussed the available opportunity for those over 70-1/2 yrs old to get a charitable donation deducted from one's taxable received "required minimum distributions" from one's pre-tax IRA savings, BUT BRINKER FAILED TO MENTION THE MOST IMPORTANT THING YOU HAVE TO DO to accomplish this objective

- THE FINANCIAL INSTITUTION HOLDING one's PRE-TAX IRA ACCOUNT, MUST pay one's chosen charities directly - THEY MUST CUT A SEPARATE CHECK PAYABLE TO EACH OF YOUR CHOSEN CHARITIES!

- Such taxpayers then get to exclude from taxable income (from "Adjusted Gross Income" also) the total of such directly made donations making them not subject to income taxation.

IF THE TAXPAYER IS ON THE CUSP OF A TAX BRACKET INCREASE; such reductions to taxable income (and AGI) could have some or all of the following impacts on the taxpayer:

- Could lower means tested Part-B Medicare Premiums deducted from received monthly Social Security checks.

- Could cause avoidance of the additional 3.8% surtax on investment income.

- Could lower the tax bracket for figuring income tax liability on taxable income.

HOW DO I KNOW ALL ABOUT THIS? I just personally went through the process with Brinker's favorite mutual fund family in Valley Forge, PA! While they have forms for this stuff, they'll do it all over the telephone if you have your list of chosen charities and related donation amounts ready to communicate. You get their prepared checks in the mail for photcopying and mailing in with each charity's donation forms.

I wonder how many listeners will now act on Brinker's misleading incomplete radio advice by writing their own personal checks to charities, instead of getting their mutual funds or other financial institutions to pay such charities directly as required by the IRS laws??

THE MOTTO FOR HEARING TAX ADVISE ON THE RADIO = MISTRUST and VERIFY!

Ah but Bob sure does those radio voice inflextions well, doesn't he!

Best wishes for a Merry Christmas and HAPpy New Years,

P

David Korn's Stock Market Commentary, Interpretation of Moneytalk (Bob Brinker Host), Financial Education, Helpful Links, Guest Editorials, and Special Alert E-Mail Service. Copyright David Korn, L.L.C. 2013

David Korn's Stock Market Commentary, Interpretation of Moneytalk (Bob Brinker Host), Financial Education, Helpful Links, Guest Editorials, and Special Alert E-Mail Service. Copyright David Korn, L.L.C. 2013

| Simple, 100% invested in Vanguard Stock Index Funds Portfolio | Total US Stock Market Index | Total International Stock Index |

| Ticker | VTSMX | VGTSX |

| Allocation | 70.0% | 30.0% |

| YTD Gain/ (loss) as of 11/30/13 | 29.93% | 13.63% |

| Weighed Return | 20.95% | 4.09% |

| Combined Return | 25.0% | |

| Simple, 100% invested in Fidelity Stock Index Funds Portfolio | Spartan Total Market Index | Spartan International Index |

| Ticker | FSTMX | FSIIX |

| Allocation | 70.0% | 30.0% |

| YTD Gain/ (loss) as of 11/30/13 | 29.95% | 19.66% |

| Weighed Return | 20.97% | 5.90% |

| Combined Return | 26.9% | |

- This means you get inflation plus 0.20% for the next 30 years. For more, see Series I Bonds Explained

- I think Series I-Bonds are very attractive for cash in taxable accounts. You can buy up to $10,000 per Social Security number.

Best CD and Savings Rates: Best CD Rate Survey

|

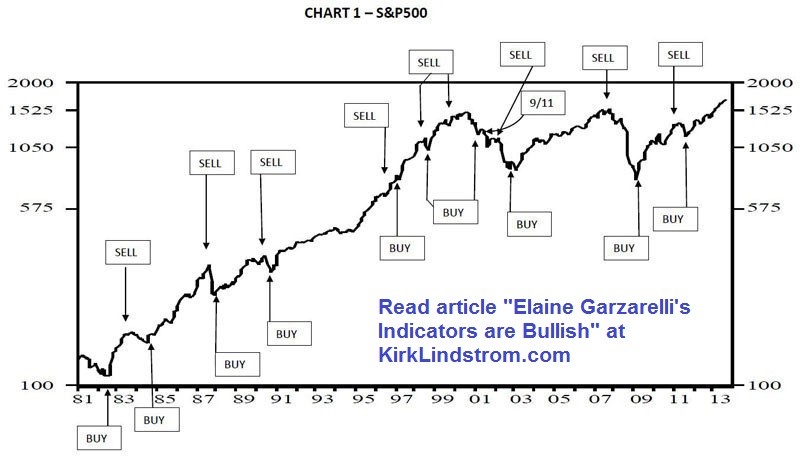

| Chart 1 Elaine Garzarelli's buy and sell signals vs. the S&P500 from 1981 through today |

|

| Click for Full Size Image |

David Korn's Stock Market Commentary, Interpretation of Moneytalk (Bob Brinker Host), Financial Education, Helpful Links, Guest Editorials, and Special Alert E-Mail Service. Copyright David Korn, L.L.C. 2013

"The bottom line? The inescapable conclusions is that the average transaction that an advisor does is a mistake, at least in the sense that he would be better off if he hadn't undertaken it in the first place."We may joke that Brinker's "Marketimer" newsletter model portfolios have been fully invested without an allocation change and very few model portfolio changes since March of 2003, but with Hulbert's data supports this idea.

|

| Brinker Income Portfolio at start of year |

|

| Component Performance YTD for Brinker Income Portfolio |

Bob Brinker

=> Beginning Investors: Getting Started

=> Recommended Reading List

=> Asset Allocation History

=> Bob Brinker Fan Club

=> Bob Brinker's QQQ Advice

=> Effect of QQQ advice on reported results

=> 3/28/08: Recession of Choice

=> 5/31/08: Cassandra Bashing

=> 3/16/09: Fan Explanation

=>Marketimer Performance

=>Brinker Fixed Income Advisor Performance

Money

=>Payday Loans - Warning

=>Very Best CD Rates (survey)

=>How to Get the Best CD Rates

=>Beware of Annuities

=>I-Bonds Explained

=>Safe Withdrawal Rate Articles