Market Update for March 31, 2023

Market Update for March 31, 2023

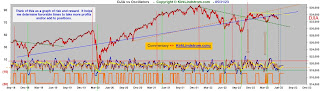

Five of twelve months into 2023, we have a split market with the Dow and the Russell 2000 indexes down

while the S&P 500 and the Nasdaq indexes are up

while the S&P 500 and the Nasdaq indexes are up

.

.

All four market indexes remain down double digits from their ATHs (All Time Highs) also summarized in the same table.

S&P 500 Stocks YTD Heat Map where the size of the boxes represents the market capitalization (share price times shares outstanding) . Meta, AKA Facebook, more than doubled during the first five months of 2023.

My Results YTD are Impressive if I may say so myself...

- I'm roughly matching SPY YTD with only 57% in the markets AND I'm only 6.6% below my record high!

- My Explore Portfolio stocks on their own are up roughly 15.8% YTD!

- Over the long term, I've smashed the index which very, very few have done.

The best news, that my long-term subscribers are well aware of, is my mix of stocks (as opposed to Warren Buffets for example) are generally leading market indicators. That is they start going up early in bull markets, probably because they are mostly "picks and shovels" companies. Likewise, they start to go down while everyone else thinks the markets should keep going higher. Knowing this helps me improve my overall returns by being more or less aggressive buying dips or taking profits depending on where we are in the cycle.

To see what stocks and ETFs are in my "Explore Portfolio" and get a full list of on my price targets to both take profits or buy more:

Subscribe NOW and get

the May 2023 Issue for FREE!!!

(If you mention this ad)

the May 2023 Issue for FREE!!!

(If you mention this ad)