From Calculating Expected Inflation using the TIPS Spread

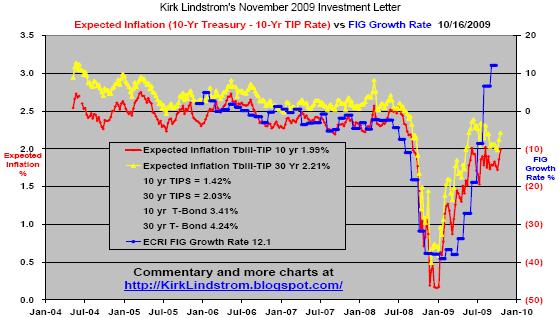

Expected Inflation or TIPS Spread is the difference between nominal US Treasury bond rates and rates on US Treasury Inflation-Protected Securities. This spread is an indicator of expected inflation. The current rates are listed in table at the end of this article.

- Using 10 year rates, expected inflation is 1.99%

- Using 30 year rates, expected inflation is 2.21%

- US Treasury Rates at a Glance

This graph shows expected inflation vs. the growth rate of ECRI’s FIG going back to 2004.

ECRI FIG: The Economic Cycle Research Institute, ECRI, monitors over 100 cyclical indexes for major economies and uses the data in effort to make economic forecasts. ECRI's U.S. Future Inflation Gauge, US-FIG,is designed to anticipate cyclical swings in the rate of inflation. On Oct. 2, ECRI’s US-FIG rose again from its March 2009 51-year low to an 11-month high. ECRI's managing director, Lakshman Achuthan, said "the upturns in the US-FIG and its components have become fairly pronounced, pervasive and persistent. Thus, while this is not yet a significant policy concern, U.S. inflation is on the cusp of a cyclical upswing.”

Supply and demand issues can distort the TIPS Spread so buyers need to beware. For example, the Federal Reserve has been busy buying US Treasuries to help banks. The TIPS spread could widen when the Fed stops buying treasuries or goes into tightening mode.

Since 12/31/98 "Kirk's Newsletter Explore Portfolio" is UP 154% (a double plus another 54% !) vs. the S&P500 UP at tiny 5.8% vs. NASDAQ down 0.9% (All through10/14/09 )

As of October 14, 2009, "Kirk's Newsletter Explore Portfolio" is up 30.7% YTD vs. DJIA up 14.1% YTD

(FREE Sample Issue)

Must Read: Beware of Annuities

Supply and demand issues can distort the TIPS Spread so buyers need to beware. For example, the Federal Reserve has been busy buying US Treasuries to help banks. The TIPS spread could widen when the Fed stops buying treasuries or goes into tightening mode.

U.S. Treasury Rates - 10/15/09

| COUPON | MATURITY DATE | CURRENT YIELD % | |

| 3-Month | 0.000 | 01/14/2010 | 0.06 |

| 6-Month | 0.000 | 04/15/2010 | 0.15 |

| 12-Month | 0.000 | 09/23/2010 | 0.32 |

| 2-Year | 1.000 | 09/30/2011 | 0 .95 |

| 3-Year | 1.375 | 10/15/2012 | 1.49 |

| 5-Year | 2.375 | 09/30/2014 | 2.35 |

| 7-Year | 3.000 | 09/30/2016 | 2.99 |

| 10-Year | 3.625 | 08/15/2019 | 3.41 |

| 30-Year | 4.500 | 08/15/2039 | 4.24 |

| TIPS - 10/15/09 | |||

| COUPON | MATURITY DATE | CURRENT YIELD% | |

| 5-Year | 1.250 | 04/15/2014 | 0 .71 |

| 10-Year | 1.875 | 07/15/2019 | 1.42 |

| 20-Year | 2.500 | 01/15/2029 | 2.00 |

| 30-Year | 3.375 | 04/15/2032 | 2.03 |

Since 12/31/98 "Kirk's Newsletter Explore Portfolio" is UP 154% (a double plus another 54% !) vs. the S&P500 UP at tiny 5.8% vs. NASDAQ down 0.9% (All through

As of October 14, 2009, "Kirk's Newsletter Explore Portfolio" is up 30.7% YTD vs. DJIA up 14.1% YTD

(FREE Sample Issue)

HURRY! Subscribe NOW and get the October 2009 Issue for FREE! !

(Your 1 year, 12 issue subscription will start with next month's issue.)

(Your 1 year, 12 issue subscription will start with next month's issue.)

Must Read: Beware of Annuities

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.