The bear market that began at the start of the year continues with all four major markets I follow down over 20% from their peaks.

Using two significant figure accuracy, the markets are down between 21% and 34% from their peaks.

If you have a horse in the November "off presidential year election" then President Biden has not made 401(k) investors happy unless their portfolios are filled with crude oil and natural gas. Investors in Bitcoin, are even less pleased. Markets & Bit Coin Under Biden

Markets & Crude Oil Under Biden

Markets, Natural Gas & Crude Oil Under Biden

In case you were interested, this is how the markets did under President Trump.

We may not like the way Mr. Trump treated people nor his contentious tweets, but the Saudis, Russians and North Koreans were much better "behaved" while he was in office. The stock markets reflected this with a quick recovery after the 2020 bear market.

Here is an excerpt from my Newsletter. SPY is slightly lower today...

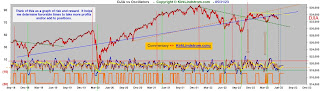

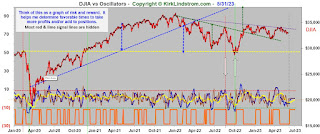

9/22/22 After several great years, it was not a surprise that SPY had a 24.5% bear market, especially with such lofty valuations in many stocks. Last month SPY rallied to its 200-day moving average then headed lower to start testing the June lows. A new low to fill the “Head & Shoulder Top” target shown just off the graph below may occur.

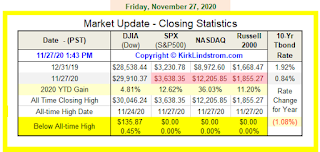

As the market is testing its bear market low sent in September, I was a buyer today and Friday with "Special Alert" emails sent to my subscribers. Bob Brinker's portfolios: At the end of Q3 on September 30th, Brinker's fully invested portfolios one and two were down 26.9% and 26.2% YTD, respectively while the Total Stock Market and S&P 500 were down 24.9% and 23.95%, respectively.

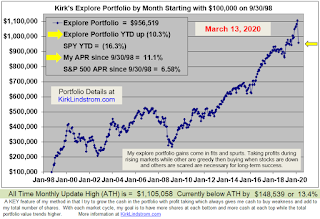

For comparison, my Explore Portfolio was down "only" 19.47% with my Aggressive Core Portfolio down 20.52% and my Conservative Core Portfolio was down 12.55%.

Three reasons I'm significantly ahead of buy and hold so far this year:

- I recommend cash in money funds rather that the Total Bond or other regular bond funds.

- I've recommended and hold significant holdings in iBonds that never go down and currently pay a very good return of between 9.62% and 9.83%!

Current Rates for New & Older I Bonds

- I took profits in all portfolios at the start of the year just as the markets were peaking.

To see what stocks and ETFs are on my buy list and what are my price targets:

Subscribe NOW and get

the October 2022 Issue for FREE!!!

(If you mention this ad)

Market Update for March 31, 2023

Market Update for March 31, 2023