skip to main |

skip to sidebar

For Bob Brinker readers who are seeking to minimize DURATION in their Fixed Income portfolio in anticipation of a rising interest rates going forward, you should consider Vanguard's two new ultra short duration bond funds.

They are Vanguard's:

- VUBFX - Ultra-Short-Term Bond Fund Investor Shares

- VUSFX - Ultra-Short-Term Bond Fund Admiral Shares

Fund Comparison

Fund

|

Minimum

Investment

|

Current

Yield

|

Expense

Ratio

|

Average

Duration

|

VUBFX

|

$3,000

|

1.30%

|

0.20%

|

0.9 years |

VUSFX

|

$50,000

|

1.35%

|

0.12%

|

0.9 years

|

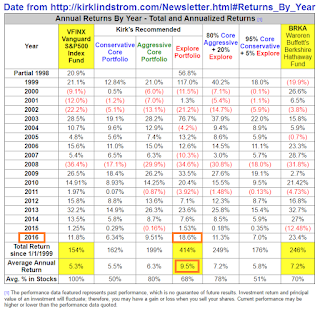

For my recommendations for fixed income investments, read "Kirk Lindstrom's Investment Letter.

"

Bob Brinker talked about Vanguard's Ultra Short Term Bond Fund. This is a new fund from Vanguard that they announced on November 24, 2014. Key features:

- The new fund, which is scheduled to launch in early 2015, will offer investors low-cost exposure to money market securities and high-quality short-term bonds* with an average estimated duration of one year.

- However, the fund should not be viewed as an alternative to money market funds, which seek to offer a stable $1 net asset value.

- Unlike a money market fund, Vanguard Ultra-Short-Term Bond Fund will have a fluctuating net asset value and subject you to principal risk.

- Expense ratio as of 02/10/2015 is 0.20%

- SEC yield as of 02/13/2015 is 0.00% (yes, ZERO!) It just started Friday so it may have to buy some bonds and subtract the management fee before it can calculate a higher yield.

Currently (2/16/15) you can get 1.00% at two banks that offer FDIC insurance. This rate tool helps find the best rates for savings accounts:

Due to the risk to principal if rates go up this year, I'd go with an FDIC savings account at 1.00% instead. If your cash is in a Vanguard IRA, perhaps you can move your cash out of Vanguard and into an IRA at one of these banks to get the full 1%.