Key Points:

- If someone moves from a money market fund yielding 0.11% into a bond fund yielding 2.52%, he or she would pick up 2.41 percentage points in current yield. On a $10,000 investment, that equates to $241 a year, assuming interest rates remain steady.

But....

- If rates were to increase by, say, 4 percentage points to 6.52%, the impact to a bond fund with an average duration of 4.3 years means the share price would drop by 17.2% (for a total drop in account balance of $1,720 on the $10,000 investment), all else equal.

In my own account and in "Kirk Lindstrom's Investment Letter" portfolios, I am totally out of bonds and bond funds not indexed to inflation. I own and recommend TIPS, TIPS funds, Series-I Bonds, CDs with FDIC and CASH in money funds and other savings accounts.

American Express Bank is offering 1.30% and I've seen higher with a bonus at

CapitalOne Bank through Costco.

In 2009 Vanguard's TIPS fund,

VIPSX, gained 10.8%

In 2009 Vanguard's GNMA fund,

VFIIX, gained 5.3%

As of yesterday (10/6/10)

VIPSX is up 9.05% YTD

VFIIX is up 7.08% YTD

I dumped my Vanguard GNMA (VFIIX) fund almost 2 yrs ago in my Vanguard ROTH and bought the TIPS fund VIPSX. Total gain as of yesterday for VIPSX was 22.5%!

The REIT index fund at Vanguard, part of my core portfolios recommended for conservative and aggressive investors, is up

22.55% YTD! It gained 29.6% in 2009 but lost 38% in 2008 so it is volatile.

Also make sure you read

Vanguard Lowers Admiral Shares Minimum to $10,000

Key points:

- Vanguard has reduced the minimum amount required to qualify for Admiral™ Shares to $10,000 for most of our broad-market index funds and $50,000 for actively managed funds, down from the previous $100,000 minimum.

- Admiral Shares cost significantly less than traditional fund shares, and their expense ratios are among the lowest in the mutual fund marketplace.

Now all my core portfolio funds will have even better returns!

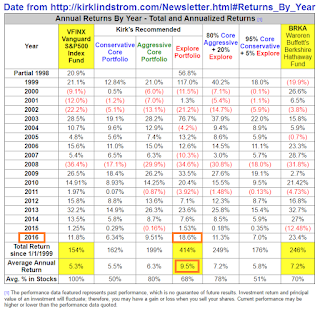

Since 12/31/98 "Kirk's Newsletter Explore Portfolio" is UP 171% (a double plus another 71%!!) vs. the S&P500 UP a tiny 14.5% vs. NASDAQ UP a tiny 8.7% (All through 10/7/10) (More info - FREE Sample Issue)

Subscribe NOW and get the October 2010 Issue of "Kirk Lindstrom's Investment Letter" for FREE! (Your 1 year, 12 issue subscription will start with next month's issue.)