Yesterday all markets (not counting dividends) closed in the red.

Bob Brinker's Marketimer newsletter has an "Income Portfolio" but Bob Brinker doesn't usually report monthly results for it. This year the bond market has surprised many with how well it has done despite the fear of the Federal Reserve increasing the Fed Funds short term rates in 2015.

This article is an update of our Sept. 12, 2014 article;

"Bob Brinker's Marketimer Income Portfolio and Radio Advice for Cash"This graph compares the four funds in the Marketimer Income Portfolio with Vanguard's GNMA fund and the Total Bond index fund.

Fund summary:

- DLSNX, up 1.46% YTD

- FFRHX, up 0.79% YTD

- MWLDX, up 1.59% YTD

- OSTIX, up 1.86% YTD

Compare that to:

The "Marketimer

Income Portfolio" has drastically under performed the total bond index

and Vanguard's GNMA funds this year. Of course, safe CDs and Series I

Bonds, that I recommend have done the same but they have zero credit or

interest rate risk.

I don't like SOME of the funds in Brinker's income portfolio because their returns are correlated to the stock market (they go down when stocks go down) which exactly the opposite of what you want in a "balanced portfolio." The two funds that have seen returns plunge much like the stock market are loaded with high risk "junk bonds" that do poorly when stocks do poorly.

I'd rather own stocks with half my balanced portfolio in something like the Total Stock Market

(VTSMX) or the S&P500 (VFINX) and get higher returns when stocks go up then keep the other half in something completely safe like CDs and I bonds discussed above.

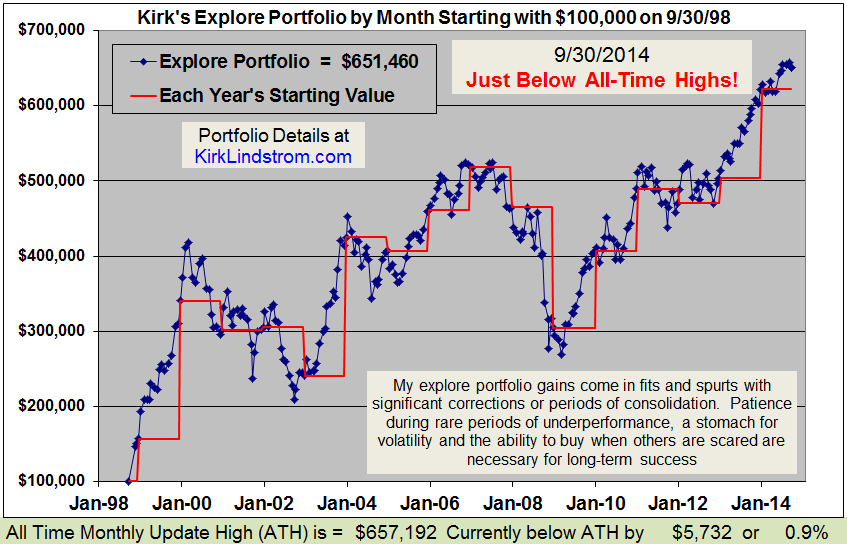

Learn the

"Core and Explore" approach to investing

with "Kirk Lindstrom's Investment Letter"

with "Kirk Lindstrom's Investment Letter"