Below is David Korns "interpretation" of the January 2 and 3, 2010 Moneytalk (Bob Brinker Host) shows. You can read more about David Korn

here.

Background: David Korn and I have been writing about Bob Brinker since the 1990s. I also write about other financial pundits such as

Jim Cramer,

Bill Flanagan,

Sy Harding,

Lynn Jimenez and

Suze Orman.

It became clear to us that many of the popular TV, internet and radio pundits were too aggressive for those in or about to enter retirement. For example, Bob Brinker had is conservative "balanced model portfolio #3" at nearly two thirds equities when the market peaked and he told a caller on the radio it was not his advice to rebalance the portfolio back to 50% equities and 50% fixed income. David and I formed a partnership and at the start of 2007 we began offering

The Retirement Advisor newsletter with our model portfolios that we felt subscribers could "sleep well at night with."

Contrary to Brinker's advice, we rebalanced our portfolios by selling equities and adding to fixed income after a good year for equities in 2007. Thus our losses at the end of 2008 were much less than Brinker's losses from the top so our subscribers could sleep better at night. Then at the start of 2009 we rebalanced again buying equities considerably lower then were we sold at the end of 2007.

As it turns out, our timing could not have been any better as all three portfolios are up over the past three years.

Performance Data.

David Korn's Moneytalk InterpretationTime to check in with Bob Brinker’s Moneytalk radio show along with editorial comments and web site links that hopefully will benefit you. Bob hosted Saturday, but on Sunday KGO Business Reporter Lynn Jimenez was guest host. I covered all of Saturday’s show below.TACTICAL ASSET ALLOCATION WATCH (based on Friday’s close)Editorial Comment ("EC"): Here is how the major market indexes have performed (excluding dividends) since Bob Brinker's timing model turned "favorable" based on the S&P 500 Index's close on March 10, 2003, and he recommended investors redeploy their cash reserves into a fully invested position by bulletin issued at 2:00 a.m. on March 11, 2003:S&P 500 Index: Up 40.31%Dow Jones Industrial Average: Up 39.84%Nasdaq Composite: Up 80.57%********************************************************************STOCK MARKET IN 2009Brinker Comment: The markets put in substantial gains in 2009. The S&P 500 put in a total return of 26.5% including dividends. Historically, that is a big number. The Total Stock Market Index put in a total return of 28.7%. The S&P 500 closed 1015.1 and the Dow closed at 10,428. The Dow had a lagging performance in 2009. But the Dow is peculiar and is not a market capitalization index and only has 30 stocks and can be a misleading barometer of what is going on.EC: I noted earlier how the S&P 500 has had a negative decade. The Dow has done even worse. When you consider inflation-adjusted returns, the Dow would have to rise another 28% from these levels just to get to the 1999 level. The Wall Street Journal published an article entitled, “Adjusted for Inflation, Dow’s Gains Are Puny” which you can read at this url:http://tinyurl.com/y99m683Brinker Comment: Over the course of the show, Bob plugged his investment letter and referred listeners to the returns on his web site at http://www.bobbrinker.com/portfolio.asp.EC: Bob’s Model Portfolios I and II which are 100% stocks outperformed the market in 2009 and he has posted those returns as well as 5, 10, 15 & 20 year returns. This is a departure from last year when he did not publish his annual returns.Kirk Comment: Note Brinker does not give his returns by year where you would learn he is still down significantly since the 2007 peak. Brinker shows his returns when they are good and doesn't disclose the years they are poor. I wish he was more like me where I disclose my returns by year

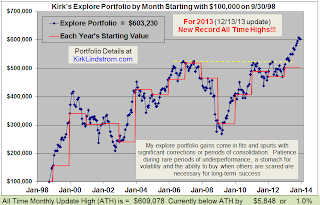

here and

here. Brinker has a newsletter called "Marketimer" which implies he can time the stock market. Disclosing data that shows he was advising 100% in equities at the very top in 2007 with a "gift horse buy" in the mid 1400s and "

bashing recession Cassandras" like me (

ECRI Calls it "A Recession of Choice") would not be good for his "market timing" business.

FIXED INCOMEBrinker Comment: On the fixed income side, we are still seeing low rates because the Federal Reserve is sticking with its policy of maintaining low interest rates to help the economy. Three-month Treasury Bill is paying just 6 basis points annually. Just one-sixteenth of one percent. The six-month Treasury Bill is paying 19 basis points annually. The one-year Treasury is yielding 44 basis points. The two-year Treasury Note is yielding 1.14%. The Five-year Note is yielding 2.70%. The 10-year Note is yielding 3.83%. The 30-year Bond is yielding 4.63%EC: Rates in all categories have all gone up a bit in the last few weeks. The Economic Cycle Research Institute’s weekly gauge of future U.S. Economic growth said its Weekly Leading Index rose to a 77-week high of 131.2 for the week ended December 25th. According to Lakshman Achuthan, managing director of ECRI, the recent growth in this leading index “points to continuing improvement in economic activity and the jobs market in coming months.” Read more at this URL:http://tinyurl.com/yk4wc69INFLATION EXPECTATIONSBrinker Comment: In order to get a handle on inflation, Bob said he compares the Treasury Inflation Protected Securities versus regular Treasuries. Currently, the 10-year Treasury Note is yielding about 3.83% and the 10-year Treasury Inflation Protected Security is yielding 1.40% which gets us an annual implied inflation rate of 2.4% over the next ten years. The current CPI is 1.8% and so these are getting close. We went through a period of deflation where there was a much bigger gap. But now that gap is closing. Looking at a longer time frame, the 20-year TIPS (longest maturity out there) is yielding 2.0% versus the 30-year Treasury Bond which is yielding 4.6% which prices in annual implied inflation rate of 2.6% over the next couple of decades.Caller: A caller told Bob he was fully expecting higher inflation and interest rates and wanted to position his portfolio of Certificates of Deposit accordingly. Bob said if you are expecting that to happen, best thing to do is to create a ladder of CDs so that you can reinvest the proceeds as maturities occur.EC: Check out this article entitled, “FED FOCUS — The coming Great Inflation, real or imagined” at this url:http://tinyurl.com/yl2dsafHIGH CREDIT CARD DEBTCaller: This 60-year old caller has a credit card with a $19,000 balance with a 9% interest rate. Should she cash in her 401(k), pay the taxes and pay off the credit card debt? The caller said she and her husband made $75,000. Bob said she would be paying 25% for the top marginal bracket, so 25 cents on the dollar plus her state income tax might mean that 30% of what she takes out is paid in taxes. And you would also be blowing up your retirement account. Bob said he didn’t like the idea and suggested she try to come up with other ways to pay off the credit card balance. Tighten up your budget, get another job, cut up the credit card, etc. Paying 9% is an extremely high rate to pay on credit, especially when you consider how low interest rates are right now.EC: The Federal Trade Commission has a good resource entitled, “Knee Deep in Debt” at this url:http://tinyurl.com/a64dfwGOVERNMENT BONDSBrinker Comment: The Municipal Bond Market and the fixed income market have both had good years. Ten-year AAA Municipal Bond General Obligations are currently yielding 3.25%. If you adjust that for a 35% top federal tax bracket, that would equate to a 5% taxable equivalent. The 30-year AAA Municipal Bond security is yielding 4.47% and that equates 6-7/8ths% for the top bracket.EC: Tax-exempt bonds are expected to return more than Treasuries for the second straight year. The average extra yield investors are demanding to buy tax-exempt bonds rated BBB instead of AAA is 270 points, compared to 50 basis points in June 2007 before the financial meltdown. Still, that is much lower than in January 2009 when the spread was 440 basis points. Check out the article entitled, “Tax-Free Shortage May Repeat Muni debt Outperforming Treasuries.”TAXESBrinker Comment: In 2010, the top federal tax bracket will stay at 35%, however, don’t expect that to last. Under current law, the top brackets will go up in 2011. The 35% bracket will go up to at least 39.6% in 2011. Whether it goes higher remains to be seen. Several tax increase proposals are being proposed in Washington. In the Senate version of the healthcare bill, they came up with the idea to increase the uncapped Medicare payroll tax which will go from 2.9% to 4.7% if you are self-employed.Bob said there is no doubt that taxes are on the rise and we are headed for a period of higher income taxes in our country. The House version of the Bill is proposing a surtax on high earners of about 5.4%. If you live in a state like California, the top state income tax bracket is close to 10.5%. Add on to that the federal tax bracket that is most likely going to 39.6% at a minimum in January 2011, along with the new proposals and you could be looking at close to 60% taxation living in California! Bob cautioned listeners that there is a general tax tsunami heading toward the people in the United States. There are proposals for taxes on stock transactions, a war tax, and the list is only getting bigger. The reason for this is because the out-of-control spending is forcing the hand of politicians to raise revenue.EC: I haven’t seen much written yet about the implications of higher taxes beginning in 2011 on the stock market but I am going to do some research on it. Presumably, individuals will make decisions toward the end of the year as people position themselves to try and be hurt as least as possible by higher taxes.I-BONDSCaller: This caller bas bought some I-Bonds at different times and noticed that some of them paid nice yields, but there were some that paid virtually nothing. How can that be? Bob noted that there was a period of time between for six months that ended October 31st where the interest was zero because we hade deflation. That ended on November 1st. The I-Bonds are earning an annual rate of interest of 3.36% for the six month period ending April 30th. And on top of that you would add the base rate which would depend on when you purchased it.EC: The Bureau of the Public Debt today announced November 2, 2009 an earnings rate of 3.36% for Series I Savings Bonds, and a fixed rate of 1.20 % for Series EE bonds, issued from November 2009 through April 2010. Earnings rates for I bonds and fixed rates for EE bonds are set each May 1 and November 1. Interest accrues monthly and compounds semiannually. Bonds held less than five years are subject to a three-month interest penalty. Both series have an interest-bearing life of 30 years; the EE bond fixed rate applies to a bond’s 20-year original maturity.WHETHER TO CONTINUE TO CONTRIBUTE TO 401(K).Caller: This caller is 2-years away from retirement and about 12 years away from needing to withdraw money. He has been advised to stop funding the 401(k) for the next couple of years because of the big tax liability he could face when he starts withdrawing. Bob said the problem with that recommendation is you are going to increase your tax liability today if you stop contributing to the 401(k) and you don’t get the opportunity to grow the money in the 401(k) tax deferred over the next 12 years. Also, many people when they withdraw are in a lower tax bracket so that is something to consider as well. Bob said if it were him he would continue to make regular contributions into the 401(k) account because of that great advantage of reducing the upfront tax liability. And since you have that money you did not pay up front to Uncle Sam, you can use it to invest.EC: The IRS recently announced that the cost-of-living adjustments for pension plans and other retirement plans for tax year 2010 will remain unchanged. This means that the contribution limits for 401(k) plans in 2010 will remain at $16,500 and for individuals over the age of 50, their catch-up contribution will remain unchanged at $5,500. That means you could put $22,000 or a $423 weekly contribution. Your company match, if any, is not counted toward these limits.IRA CONTRIBUTIONBrinker Comment: For 2010, if you are under age 50, you can put up to $5,000 in a traditional IRA account and if over age 50 you can put in another $1,000. Same applies to the Roth IRA. There are income requirements that apply to how much you are able to put in, but if you are eligible these are good accounts. Bob said he likes the Roth IRA very very much if you are eligible. Everyone is eligible for the traditional IRA. You can fund the 2009 IRA up until April 15, 2010.EC: Consult the Infernal Revenue Service’s web page on 2010 Traditional and Roth IRA Contribution Limits at this url:http://tinyurl.com/4wtorbROTH IRA CONVERSIONCaller: This caller is in a high tax bracket and has been funding a self-directed IRA. He has the opportunity to convert to the Roth IRA but he would have to pay taxes. Bob said he is not a big fan of converting to a Roth when you are in a high tax bracket. Bob said he has an IRA and he has not converted. Bob said he would rather have the money working for you. If you were in a zero or really low bracket that might be a different story.EC: Check out this article entitled, “Roth IRA conversion not worth the taxes”:http://tinyurl.com/y92oghlMORE GOVERNMENT BAILINGCaller: This caller wanted Bob’s opinion on the additional funding by the government to Fannie Mae/Freddie Mac and GMAC. Bob said there is a big difference between the two. The $3.5 billion additional pledge to GMAC is a relatively small development to the trillions on the line. The unlimited Fed backstop to Fannie and Freddie, however, is going to be a lot of money. Bob said the government has been on a campaign over the last decade encouraging people to buy their own house and this is where it has taken us. The government is trying to provide liquidity and stability to the mortgage market through their backing of Fannie Mae and Freddy Mac. But it is taxpayer money make no mistake.EC: Here is a link to the Treasury Announcement on the Restructuring of Commitment to GMAC:http://tinyurl.com/yf3maz5EC: Here is a link to the Treasury Update on the Status of Support for Housing Programs:http://tinyurl.com/yc3q655THE BIGGEST CHALLENGE FACING THE FEDCaller: Can we trust the Fed will eventually be able to tighten and pull back stimulus when the time comes? Bob said this will be one of the biggest challenges Ben Bernanke will face in 2010 and forward — getting the excess liquidity out of the system while not hurting it. It is a huge challenge. A lot of that excess liquidity is not doing anything for the economy, it is just sitting on deposit at the Federal Reserve. It is not really developing anything in terms of the monetary multiplier. It is just idle money sitting at the Fed. But eventually this will have to be resolved with an orderly withdrawal.EC: In a speech last month to the Economic Club, Ben Bernanke framed his remarks as answers to frequently asked questions at this url:http://tinyurl.com/yeund9xEC#2: And just yesterday, hot off the presses, Bernanke gave a speech entitled, “Monetary Policy and the Housing Bubble” which makes for good reading if you want to ran out of Tylenol PM. Check it out at this url:http://tinyurl.com/y9w9cqyHEALTH SAVINGS ACCOUNTCaller: This caller asked Bob his opinion on Health Savings Accounts. Bob said he likes them and if you are in a position to do it you should. In fact, you can still fund your 2009 tax amount. For single coverage, you can put up to $3,000 of $5,950 for a family. If you are over age 55, you can put in another $1,000. You can do that up until April 15, 2010. Bob said you can set up an Health Savings Account through your financial institution. This is a terrific way to put some money away, take advantage of the tax privileges and have the ability to pay medical expenses.EC: A Health Savings Account is an alternative to traditional health insurance; it is a savings product that offers a different way for consumers to pay for their health care. HSAs enable you to pay for current health expenses and save for future qualified medical and retiree health expenses on a tax-free basis. You must be covered by a High Deductible Health Plan (HDHP) to be able to take advantage of HSAs. An HDHP generally costs less than what traditional health care coverage costs, so the money that you save on insurance can therefore be put into the Health Savings Account. Also, you own and you control the money in your HSA. Decisions on how to spend the money are made by you without relying on a third party or a health insurer. You will also decide what types of investments to make with the money in the account in order to make it grow. Consumers can sign up for HSAs with banks, credit unions, insurance companies and other approved companies. Your employer may also set up a plan for employees as well. An HSA is not something you purchase; it’s a savings account into which you can deposit money on a tax-preferred basis. The only product you purchase with an HSA is a High Deductible Health Plan, an inexpensive plan that will cover you should your medical expenses exceed the funds you have in your HSA. However, HSA trustees often will charge fees for their services. To learn more, go to this url:http://tinyurl.com/y3vujkMONEYTALK GUESTSOn Saturday, Bob had on Joseph F. Hurley, author of “The Best Way To Save for College --- a Complete Guide to 529 Plans” As noted earlier, Bob did not host Sunday's show and the substitute host,

Lynn Jimenez, isn't worth summarizing.

David Korn Links:

Don't miss out! Click here to start your subscription to The Retirement Advisor now!

| The Retirement Advisor Portfolios | Dollar Value on 12/31/09 | Change |

| Model Portfolio 1 | $214,500 | 7.2% |

| Model Portfolio 2 | $224,106 | 12.1% |

| Model Portfolio 3 | $237,109 | 18.6% |

| DJIA 12,501.52 on 1/1/2007 | $10,428 | (16.6%) |

| S&P500 1,418.30 on 1/1/2007 | $1,115.10 | (21.4%) |

The Retirement Advisor Model Portfolios all began with $200,000 on 1/1/2007

Click here to start your subscription to The Retirement Advisor now!

As noted earlier, Bob did not host Sunday's show and the substitute host,

Lynn Jimenez, isn't worth summarizing.