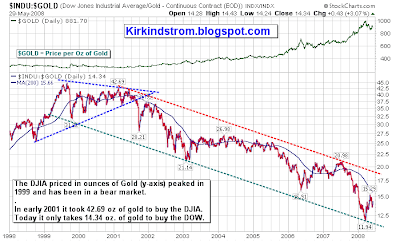

Bob Brinker had a lot to say about gold (

Quote and Charts) and inflation this weekend on "

Moneytalk." Below is David Korns "interpretation" of the September 19 and 20, 2009 Moneytalk (Bob Brinker Host) shows. You can read more about David Korn with links to his two newsletters at the end of this article.

Caller: This caller read in Marketimer that Bob believes we can expect improvement in the economy as we move into 2010. With all of the spending going on, and the price of gold going up, when will this initiate inflation that starts negatively impacting the economy. And should he invest in gold? Bob said earlier this year he added to the individual issue section of his Marketimer newsletter that for subscribers who wanted to have some of their portfolio in gold as a hedge, such as a few percentage points, Bob recommended the SPDR Gold Shares (ticker:

GLD).

Bob said he strongly recommended using the GLD shares IF you wanted to hedge your portfolio with a position in gold. They are currently trading at $98.67 which are near their all-time high. Bob said he likes those shares because they have a low expense ratio, of only about 0.40%. Plus they have an excellent history of tracking gold bullion. Bob said to avoid the various gold schemes out there and stick with an exchange-traded fund like this one.

Kirk Comment: GLD Current Quote and ChartsDAVID KORN: I need to give my subscribers a little warning here about this recommendation by Bob. Since he listed the GLD shares in the "individual issues" section of his newsletter, they are not included in the performance of his model portfolios. To that extent, they get relegated to the

QQQQ status (See Kirk Comment). If they go up, Bob can brag about it, but if they go down, it doesn't affect his published performance figure and you probably won't hear him talk about it further.

If you listen carefully, Bob is saying he is recommending it to people who WANT to hedge their portfolio against inflation, not because HE thinks there is going to be inflation.Kirk Comment: Make sure you read:

=> Bob Brinker's QQQ Advice

=> Effect of QQQ advice on reported results

DAVID KORN#2: I think gold these days has a place in a portfolio, beyond just hedging against inflation. Gold does well during periods of political uncertainty, war, etc. And I like the idea of diversifying across many different asset classes. Gold is just too pricy for me to establish a new position in it at this juncture.

Caller: This caller has owned gold (via GLD) shares for some time. She is interested in purchasing some old gold coins. Bob said he would stay away from numismatic coins. Bob said for the average investor numismatics are too expensive because of the mark ups which can be quite substantial. If you are going for real gold, Bob said to stick with gold bullion where you pay the smallest premium. Currently, that would be the the Australian Crown which has a premium of about 0.3% and the Mexican Peso gold coin about 0.66% premium. Those are the best value. If you want to go to the Canadian Maple Leaf, that premium is running about 4.5%. The U.S. Eagle is also around a 4.5%. Those are not numismatic coins, they are pure gold content coins.

DAVID KORN: I agree with Bob that investing in gold coins is a hard way to go as an investment. Basically, only if you are a collector or someone in the numismatic business would it probably be a money making opportunity. However, if you want to learn more about this subject go the web site run by the American Numismatic Association, which is a nonprofit educational organization at this url:

http://www.money.org

INFLATION CALLS AND COMMENTS Caller: How long will it take to see hyper-inflation given the rate at which the Fed is printing money. Bob said right now we have deflation, not inflation. Over the last year, prices have dropped 1.5%. The problem is when you have an economy that has a tremendous amount of slack in it, which is what we have right now, particularly in areas like unemployment which is close to 10%. When you get too much slack as we have right now, you get deflation.

DAVID KORN: Bob didn't address when we might get inflation in response to this caller, merely noting that we have deflation right now. That¹s the big question of course. It will happen down the road at some point, the question is when. According to the last report from the Economic Cycle Research Institute, their U.S. Future Inflation Gauge has risen from a 51-year low in March to a 10-month high in August. According to ECRI, ³the risk of deflation has clearly dissipated for now, but inflation is not yet a clear and present danger.²

Caller: Isn't deflation being caused by slack in demand for goods and services? Bob agreed that was part of the equation, but you can¹t underestimate the impact of unemployment which has been in an uptrend because it as a lagging indicator. Employers have so many people they can go to and interview for jobs and puts downward pressure on labor costs. This is good for businesses and helps keep prices down. There is a tremendous surplus of qualified workers in the aggregate. That is one of the reasons you are looking at deflation right now at 1.5%.

DAVID KORN: See the article, "Falling prices raise specter of deflation" at this url:

http://tinyurl.com/m4v9r2

Brinker Comment: Yes, the Fed is printing money, but that alone does not cause inflation. You need a growing economy as well. One of the inflation forces is demand pull inflation where the demand for goods becomes so overwhelming relative to the supply outstanding that pulls prices higher. No sign of that. The other kind is cost-pull inflation where the cost of producing goods is so overwhelming ‹ frequently due to higher labor costs ‹ that it pushes prices higher. We certainly don¹t have that now with the historic amount of slack in the economy today. You have to go back to the 1980s to find the amount of labor slack. If you use the U-6 calculation for employment, which includes people who have part time jobs who would like full time jobs and the people who have given up looking for work, that number gets up to 16.8% which is a very very high number. Right now, we have the opposite of demand pull and cost push and as a result we have deflation.

Brinker Comment: There is inflation risk if the economy picks up to a smart pace of growth. When consumers and corporations start to compete with the government for borrowed money, that is when you can see the possibility of inflation. We don¹t have that right now. And in fact, we have the opposite, deflation.

Brinker Comment: In order to get a handle on inflation, Bob said he looks at the 10-year Treasury Inflation Protected Security which is yielding 1.63% and compares it to the 10-year Treasury Bond which is yielding 3.47%. The difference shows us an implied annual rate of inflation over the next ten years of 1.84%. Right now in our country, the rate of inflation is minus 1.5% which is deflation. So in order to get up to the long term implied rate of inflation, we would need to get inflation of 3.3% from current levels.

DAVID KORN: In the latest report this week, the Consumer Price Index showed an increase of 0.4% last month. Excluding food and energy, the core CPI rose just 0.1%.

Brinker Comment: Bob said if down the road, he saw a hyper-inflationary outlook, that could impact the level he would be willing to place at risk in the stock market and could result in a defensive move.

DAVID KORN: Inflation always played a role in Bob¹s stock market timing model, so I am not surprised by this comment.

Kirk Comments:

| Date | Close |

| 24-Sep-09 | 97.55 |

| 23-Sep-09 | 98.83 |

| 22-Sep-09 | 99.67 |

| 21-Sep-09 | 98.36 |

| 18-Sep-09 | 98.67 |

| 17-Sep-09 | 99.34 |

| 16-Sep-09 | 99.91 |

David Korn Links: