This week Bob talks about the FOMC meeting that he refers to as a "pajama party."

- Money Talk - 6/14/15 - Hr 2

- See below for links to past shows

Bob also said the language of the statement was most important and he didn't expect the FOMC to change rates at this meeting. Bob thinks rates could stay unchanged until the "Autumn season."

Today Fed Chair Janet Yellen had a press conference and explained why they left rates unchanged after their "pajama party."

Listen now by clicking the links or right click and save the mp3 file to your hard drive and listen later.

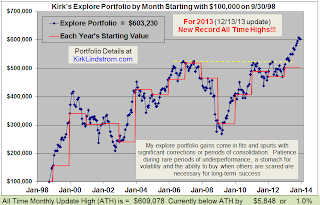

Learn "Core and Explore Investing" with "Kirk Lindstrom's Investment Letter."

- Subscribe NOW and get the June 2015 Issue for Free!

Next Sunday you can Listen Live (unless he does another recorded show) to Moneytalk with Bob Brinker at:

- Phoenix, AZ: KFNN 1510AM: All three hours

- Denver, CO: KNUS 710: All three hours

- (1PM to 4PM PST, 4PM to 7PM EST)

Disclaimer: I own Series I Bonds in my personal account (some have base rates of 3.0%! I also currently have them in my Newsletter Explore Portfolio.

For my advice on what to do with your older I bonds as well as new money, read my newsletter!

- Subscribe to Kirk Lindstrom's Investment Letter NOW and get the June 2015 Issue for Free!