Yesterday Peter Brimelow

reported that his "Bold Bulls are bloodied but unbowed." He says the bold bulls are all "shaken by the economy's deterioration, but still positive long-term."

About Bob Brinker, Brimelow wrote:

Brinker said recently: "Marketimer views the establishment of a correction bottom as a process which unfolds over a given period of time. This process involves the initial establishment of a closing S&P 500 Index low, followed by a short rally, followed by a test of the area of the previously established low on reduced trading volume. The initial closing low in the current stock market correction process occurred on Jan. 22, when the S&P 500 Index closed at 1310.50. The market subsequently rallied for eight days, at which point it began the process of testing the area of the Jan. 22 closing low."

"In our view, the correction bottoming process has proceeded with a high degree of historical consistency to date. We have witnessed a decided reduction in selling pressure during the testing process, which is essential to a successful outcome. We now rate the stock market attractive for purchase on any weakness that occurs in the current area of the S&P 500 Index low 1,300s, or any minor weakness that occurs below that level."

Market timer's summary: "As has been the case with every correction since August of 2007, several stock market pundits are claiming that a bear market is underway. We do not believe this is the case. We expect the S&P 500 Index to work its way into record new high ground by late this year or in 2009."

It should be noted that with the S&P500 at 1411, Bob Brinker sent out a bulletin to his subscribers on August 16, 2007 that said:

"Any further testing of the area of the correction lows, which we expect to be close to the current S&P 500 Index level (1411), is regarded as an additional buying opportunity for subscribers looking to add to stock market holdings."

and

"Marketimer expects the S&P 500 Index to register new historic record highs as we move forward into next year."

Click image courtesy of stockcharts.com to see it full sized

Bob Brinker has recommended a fully invested position all this time so it is good news for bullish investors that Bob Brinker is still bullish for the long term.

Of the other two "bold bulls" Index Rx remains bullish like Brinker:

- "Don't let the proclamations of experts frighten you into straying from your chosen strategies. Stay the course; we will be vindicated."

while Richard Band of "Profitable Investing" is defensive:

- "I continue to recommend a defensive posture for the model portfolio ... Buy gradually and cautiously, focusing on high quality blue-chip stocks (preferably those with the strongest earnings prospects for the year ahead).

Currently, Band is 69% stocks, 31% fixed income. One stock recommendation is International Business Machines (IBM)

Band writes: "Buy at $107 or less for a potential return of 20%-30% in the next 12 months."

Visit our Facebook Bob Brinker Discussion Forum at "Investing for the Long Term" to ask questions or discuss this article.

Disclaimer: I own IBM with huge gains from a big buy back in 1994 at about $11 a share when IBM was having major problems since its 1987 peak much like we are seeing today for the NASDAQ100 technology index (QQQ) that remains down over 60% from its 2000 peak. I also have shares from the 1980s via a DRIP (dividend reinvestment plan) that have done very well overall despite the bad times between 1987 and 1994.

==>Highest Yield CDs with FDIC <==

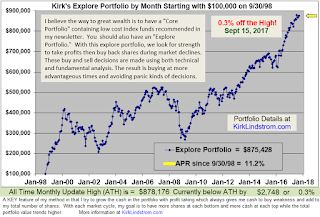

Since 12/31/98 "Kirk's Newsletter Explore Portfolio" is UP 159% (a double plus another 59%!!) vs. the S&P500 UP a tiny 8.6% vs. NASDAQ UP a tiny 3.5% (All through 12/31/09)

In 2009, "Kirk's Newsletter Explore Portfolio" gained 33.5% vs. the DJIA up 18.8%

(FREE Sample Issue)

HURRY! Subscribe NOW and get the CURRENT Month's Issue for FREE! (Just mention this article and I'll start your 1 year, 12 issue subscription with the next month's issue.)