Bob Brinker says the price of oil is a wildcard. On the July 12 Moneytalk, Brinker said:

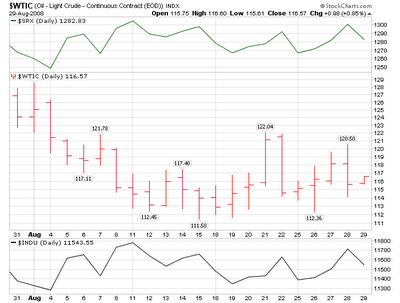

Bob Brinker says the price of oil is a wildcard. On the July 12 Moneytalk, Brinker said:"Here we see oil having closed the week at an all-time-record-high, close to $145 for a barrel of oil………..And there is an inverse relationship that has developed between upward spikes in oil prices and the stock market, and that inverse relationship has really been showing up now for some time.Concerns over the economy, inflation and troubles in the financial sector weighed heavy on investors in August despite oil prices falling about $9 from $125 to $116

The stock market wants to see an economic recovery scenario. It does not want to see an increased oil price scenario, which is was it’s seeing right now. Now I wish I could tell you what the price of oil is going to be in a week, a month, a year. I don’t know. I have no way of knowing and I think only a fool would try to forecast the price of a barrel of oil in the world we live in…….” [Full story]

Despite being fully invested since March 2003 and riding this bear market down fully invested, Bob Brinker issued yet another "all in the pool" buy level in the low 1200s in early August. So far, that was too late to do anyone any good as the market had already recovered by the time he issued a the latest buy level.

Brinker's Model Portfolio #1 (P1) Performance

Brinker's Model Portfolio #1 (P1) Performance (Data from Bob Brinker's Marketimer for end of month totals)

Brinker P1 as of 10/31/07 = $302,561Gain required for P1 from 7/31/08 to "break-even" with its 10/31/07 value is 21.0%

Brinker P1 as of 07/31/08 = $249,993

Thus P1 is down $52,568 or 17.4%

I will update this table with the August numbers as soon as they are published, but from the top graph, I would not expect them to be very different.

Bob Brinker's MOABO

I sure hope the markets have made a bottom and they do not go lower. As an asset allocator and stock picker who does not short stocks, I would love to see the market go up all the time with the occasional correction to buy back profit taking shares to add to my returns.

It would sure be ironic if Bob Brinker's original prediction of a secular bear market with a MOABO (mother of all buying opportunities) at the end of that bear market, turns out to be true. I imagine he is kicking himself raw for calling for new highs in 2008 last year just as the bear market was starting.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.